gambling income tax calculator

You may have to dust off the math book. This includes the rates on the state county city and special levels.

Reporting Gambling Winnings And Losses On Your Tax Return 1040 Com Blog

The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

. It takes into account gambling losses non-gambling income the amount of itemizable. The average cumulative sales tax rate in Piscataway New Jersey is 663. The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate.

The marginal tax rate is the bracket where. Here is a complete overview of all state related income tax return links. After youve pulled together all the above information you can calculate what you owe in taxes.

Gambling income is subject to state and federal taxes but not FICA taxes and the rate will. Gambling Income Tax Calculator - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. Enter your Home Price and Down Payment.

31 2019 taxes on gambling income in Illinois are owed regardless of what. Gambling winnings are fully taxable. Gambling Income Tax Calculator - Top Online Slots Casinos for 2022 1 guide to playing real money slots online.

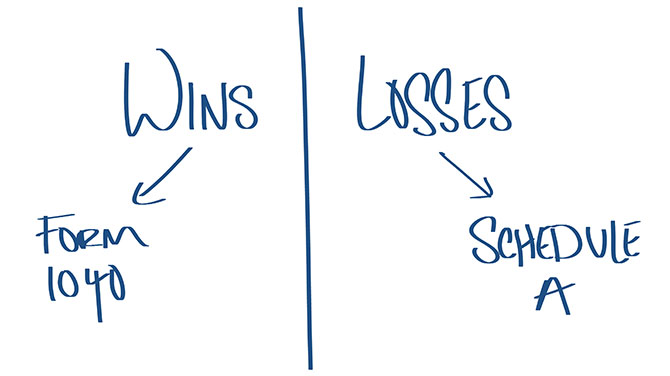

For example if players win 150000 but lose 50000 in bets the taxable income allowed as a miscellaneous deduction. As for state taxes in Ohio you report gambling. This will itemize your gambling income.

See reviews photos directions phone numbers and more for Federal Tax Calculator locations in. As with any potential revenue stream individuals will be expected to pay both Federal and State. Use this Stirling Morris County New Jersey Mortgage Calculator to estimate your monthly mortgage payment including taxes and insurance.

The state is expected to draw as much as 700 million in new taxes on gambling in Alabama. Maryland Gambling Tax Calculator. This page contains a calculator for computing the income tax liability on gambling winnings.

Calculate Your Crypto Taxes. Its determined that gambling losses are a miscellaneous deduction. Federal income taxes are also withheld from each of your paychecks.

Piscataway is located within Middlesex County. The following rules apply to casual gamblers who arent in the trade or business of gambling. Yes gambling winnings fall under personal income taxed at the flat Illinois rate of 495.

Your employer uses the information that you provided on your W-4 form to. 419 Gambling Income and Losses. You can get an indication of how much you will have to pay in Kansas gambling taxes by filling in your details on our tax calculator.

On your federal form you submit this as other income on Form 1040 Schedule 1. Discover the best slot machine games types jackpots FREE games. Tax rates depend on your annual income and tax bracket.

How Your New Jersey Paycheck Works. Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT. Taxable Gambling Income.

Players should report winnings that are. Gambling winnings are subject to 24 federal tax which is automatically withheld on winnings that exceed a specific threshold see next section for exact amounts. Discover the best slot machine games types jackpots FREE games.

Simple Tax Refund Calculator Or Determine If You Ll Owe

Tax Reform Law Deals Pro Gamblers A Losing Hand Journal Of Accountancy

What Is Taxable Income And How To Calculate It Forbes Advisor

Irs Refunds Taxes On Casino Winnings Tax Refund Calculator

1040 Tax Calculator Free Online Tax Estimator Pasadena Fcu

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

Can You Claim Gambling Losses On Your Taxes Turbotax Tax Tips Videos

Casino Gambling And Taxes How Does That Work Bestuscasinos Org

Casino Connection Casino Connection

Archives Northeast Financial Strategies Inc

Hawaii Income Tax Hi State Tax Calculator Community Tax

Calculating Taxes On Gambling Winnings In Michigan

How To Pay Taxes On Sports Betting Winnings Bookies Com

7 Tax Tips For Gambling Winnings And Losses

Income Tax Calculator 2021 2022 Estimate Return Refund

1040 Tax Calculator Austin Telco Federal Credit Union

Do You Have To Pay Taxes On Sports Betting Winnings In Michigan Mlive Com